CEO Bernard Arnault stated at Thursday’s sales conference that the growth rate is “perfectly appropriate” to sustain the market’s brand appetite.

LVMH sent a reassuring message to the luxury industry last Thursday (01/25/2024). It reported that organic sales growth in Q4 increased by 10% to around €23.95 billion, surpassing expectations. The group’s annual retail sales reached €86.15 billion in revenue, a 13% increase from €79.18 billion in 2022.

Leading the growth were Asia (up 15%) and Japan (up 20%), while the U.S. saw an 8% increase—a marked improvement from the previous two quarters, with sales down 1% in Q2 and up 2% in Q3. Europe reported a 5% increase in sales.

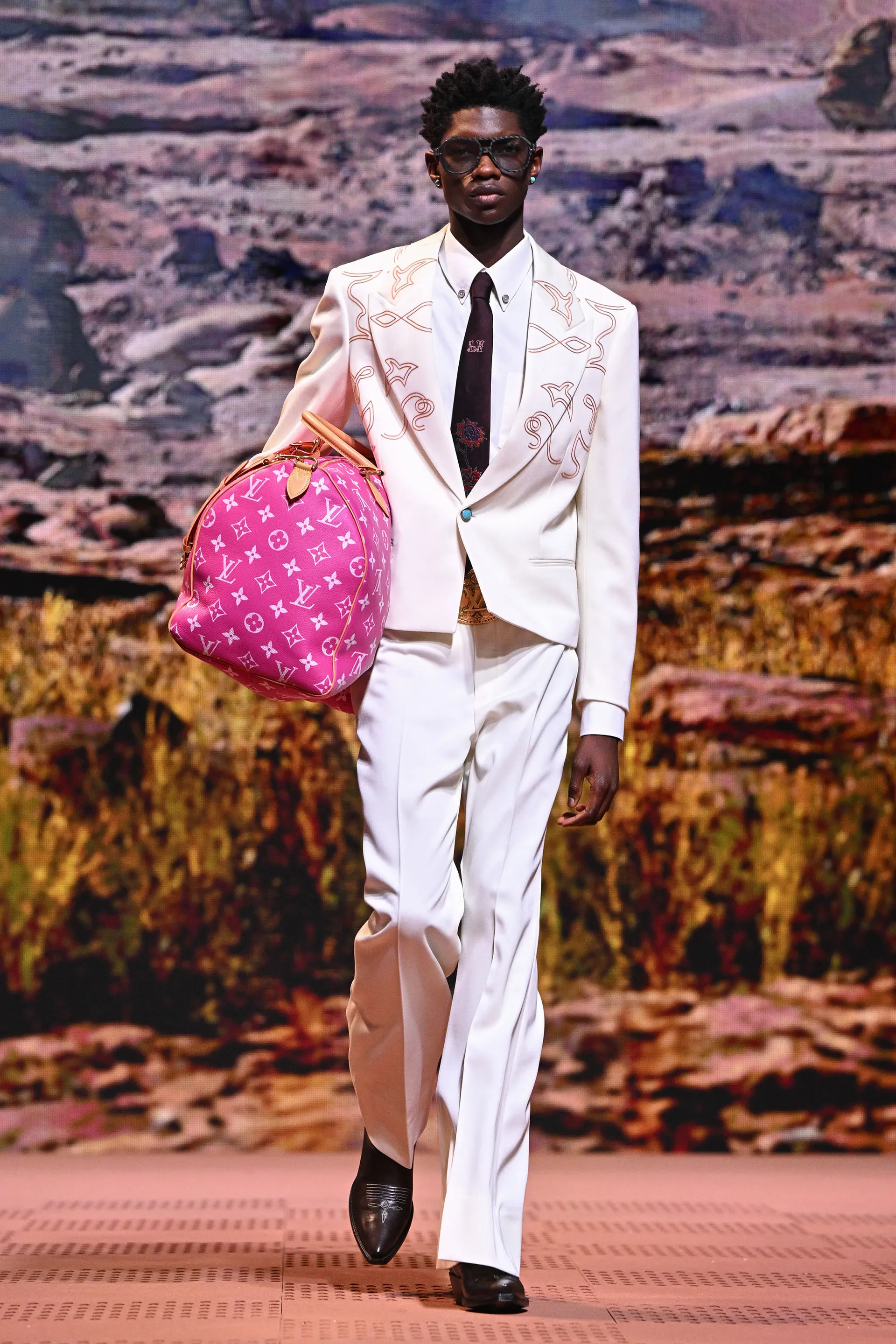

In Q4, the fashion and leather goods category saw a natural growth of 9% to €11.26 billion, in line with expectations. While LVMH doesn’t break down revenue by each brand, CFO Jean-Jacques Guiony noted that their two largest companies, Louis Vuitton and Dior, nearly matched this sector’s growth rate.

Though consistent with growth in Q3, the fashion sector slowed compared to the first half of 2023, when sales increased by 18% in Q1 and 21% in Q2. Is single-digit growth becoming the new normal?

“I’m often asked why we only achieve growth rates of 8 or 9%? I find that a growth rate of 8 or 9% is quite good, and I hope that we won’t exceed that,” LVMH Chairman and CEO Bernard Arnault said at the income report conference held in the auditorium of LVMH’s headquarters at 22 Avenue Montaigne.

“I’d rather slow down than accelerate, and in this organization, I’m lucky to have people I need to slow down. It’s easy to expand this business when we have many successful products, and therefore, all we have to do is produce more. However, in reality, we have to resist that urge. Achieving 8 or 9%, a maximum of 10% growth, is suitable for me. For the brand appetite in the market, this growth rate is entirely appropriate.”

This comes after Richemont reported an 8% increase in sales in Q4, causing stocks to rise by 8%. LVMH is another signal that the U.S. is starting to recover.

Bernstein analyst Luca Solca wrote, “We left the conference with a brief but definitely impressive impression of LVMH’s growth and reasserted our view of LVMH as the leading structural growth company in this sector.”

Jefferies analysts wrote in a note: “At a time when investors are closely monitoring, the giant has reassured—and dealt well with the sharp decline in sales momentum in the latter half.”

Arnault said Dior concluded a “firework” year in the U.S., exemplified by activities at a giant cartoon-themed display point at Saks Fifth Avenue. Arnault said, “It significantly boosted Dior’s sales across the United States.” He also emphasized the “great success of Celine by Hedi Slimane, currently achieving €2 billion in revenue, as well as Loewe.” He added that Fendi “continues to maintain growth” while Loro Piana achieved “very high growth rates.”

In Q4, Sephora drove the growth of selective retailing items, up 21%, equivalent to 7 percentage points higher than the previous consensus expectation. Perfumes and cosmetics increased by 10%, while the watch and jewelry segment, including Tiffany & Co. and Bulgari, increased by 3%. By comparison, Richemont’s jewelry brands—including Cartier and Van Cleef & Arpels—increased by 12% in the quarter.

When asked whether he wanted to establish a partnership with Richemont, Arnault replied, “We consider Johann Rupert an outstanding leader. And I don’t want to disrupt his strategy. I understand he wants to maintain independence. I think that’s good. If he wants support to maintain his independence, I’ll be here.”

Coinciding with the income discussion, LVMH announced that its board of directors would propose the appointment of Arnault’s two sons, Alexandre, 31, and Frédéric, 28, to the board at the upcoming annual general meeting (AGM) on April 18. This confirms earlier reports from the French publication La Lettre. “I think this is a good thing, besides reducing the average age of the management board. It’s very timely to rejuvenate the management team,” he said, referring to French Prime Minister Gabriel Attal, 34. “However, I have no intention of leaving in the short or medium term, so rest assured—or perhaps very sorry—but I’ll still be here for a while.”

Four of Arnault’s five sons attended. When asked if his 25-year-old son Jean, Louis Vuitton’s watch director, felt neglected, Arnault replied, “The little one still has plenty of time.” Arnault’s two eldest children, Delphine and Antoine, were both present on the board.

The uncertainty at this time is “all-encompassing,” as Bernstein’s Solca put it. But Arnault’s news will reduce this uncertainty. He said he is “very confident” about 2024. “I expect to continue the growth achieved in 2023. We’ll see throughout the year the impact of interest rate cuts; the positive impact in the U.S. of the upcoming election—every time there’s an election in the U.S., the market becomes more dynamic.” According to the luxury giant, potential concerns for 2024 come from the geopolitical situation with crises in Eastern Europe and the Middle East.

“With warnings about macro/political 2024, comments on the current market trading situation are no longer uncertain, like January 2023. But this information is enough to stabilize sentiment in the near future because the leadership has reaffirmed the focus on maintaining high growth at a single-digit,” Jefferies analysts wrote.

Related post

5 Tips to Style Hoodies on Cold Winter Days

As winter settles in, many of us find ourselves reaching for cozy essentials that provide warmth and comfort. One such wardrobe staple is the hoodie.

The Truth Behind the Rumor ‘Santa Claus Is Ugly’ That Surprises Many

As the holiday season approaches, the character of Santa Claus emerges in various forms, his iconic red suit and white beard eliciting warmth and joy

Guide to Creating a Heavy Metal Sound in the Style of Tony Iommi

Heavy metal is a genre rich with history and technical prowess, and few guitarists have influenced its sound as profoundly as Tony Iommi, the legendary

Breaking Down the Key Tactical Edgeas in the Oakland Raiders Lineup

Breaking Down the Key Tactical Edges in the Oakland Raiders’ Lineup reveals not just a football team but a storied franchise with an indomitable spirit.

The Most Heartwarming Moments of Spider Man On Screen

The world of Spider-Man is not just filled with thrilling battles and breathtaking stunts; it’s a tapestry woven with moments of profound empathy, love, and